Credit Unions in Cheyenne WY: Your Guide to Superior Financial Services

Credit Unions in Cheyenne WY: Your Guide to Superior Financial Services

Blog Article

Open the Advantages of a Federal Lending Institution Today

Check out the untapped benefits of straightening with a federal cooperative credit union, a critical monetary relocation that can reinvent your financial experience. From special participant rewards to a strong area values, government lending institution use an unique method to financial solutions that is both customer-centric and economically useful. Discover how this alternative banking version can offer you with a special perspective on economic wellness and lasting stability.

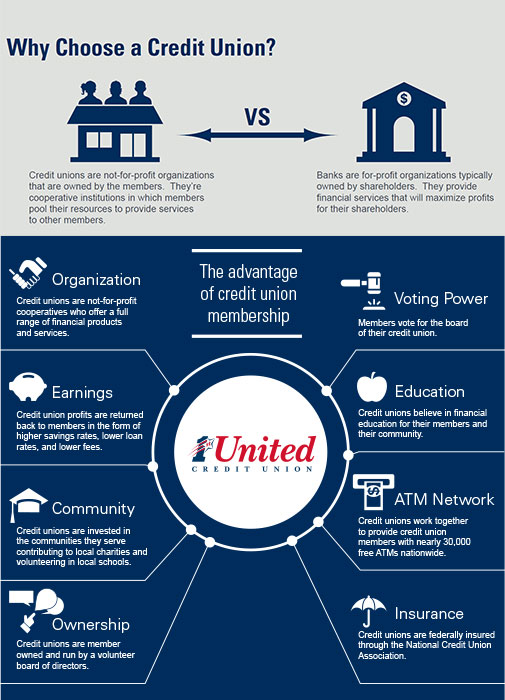

Advantages of Joining a Federal Lending Institution

One of the main benefits of signing up with a Federal Debt Union is the emphasis on member complete satisfaction rather than producing earnings for investors. Furthermore, Federal Credit history Unions are not-for-profit organizations, permitting them to use competitive interest rates on financial savings accounts, loans, and credit rating cards (Credit Unions Cheyenne).

An additional advantage of joining a Federal Credit history Union is the sense of community and belonging that members typically experience. Federal Debt Unions typically give financial education and learning and sources to help participants boost their economic literacy and make educated decisions about their cash.

Lower Charges and Affordable Prices

Furthermore, federal lending institution are recognized for offering competitive passion rates on savings accounts, fundings, and bank card (Credit Unions Cheyenne). This suggests that members can earn more on their cost savings and pay less passion on lendings contrasted to what conventional financial institutions may provide. By providing these competitive prices, government cooperative credit union focus on the economic well-being of their members and strive to help them achieve their economic goals. Generally, the lower charges and affordable prices used by government lending institution make them an engaging selection for people looking to maximize their economic benefits.

Customized Consumer Solution

A trademark of federal cooperative credit union is their commitment to supplying personalized customer care customized to the specific requirements and preferences of their participants. Unlike conventional financial institutions, government lending institution prioritize developing strong relationships with their members, aiming to provide a much more tailored experience. This tailored approach implies that members are not simply seen as an account number, but instead as valued people with unique monetary goals and scenarios.

One means government credit scores unions provide personalized client solution is through their member-focused method. Reps take the time to recognize each member's certain economic scenario and offer personalized remedies to fulfill their requirements. Whether a member is aiming to open a new account, look for a car loan, or look for monetary suggestions, federal credit history unions aim to give customized advice and assistance every step of the method.

Community-Focused Efforts

To better boost their effect and link with members, government credit score unions actively involve in community-focused initiatives that add to the wellness and advancement of the areas they offer. These campaigns frequently include economic education programs targeted at equipping people with the understanding and abilities to make enlightened choices regarding their funds (Credit Unions Cheyenne WY). By offering workshops, workshops, and one-on-one counseling sessions, lending institution aid neighborhood members improve their monetary literacy, manage debt successfully, and prepare for a protected future

In addition, government lending institution often take part in neighborhood occasions, enroller area tasks, and assistance charitable causes to attend to particular demands within their solution locations. This involvement not only shows their commitment to social duty however likewise reinforces their relationships with participants and promotes a feeling of belonging within the community.

Through these community-focused efforts, government lending institution play a vital role in promoting monetary addition, financial stability, and overall success in the areas they operate, ultimately producing a favorable impact that expands beyond their standard banking services.

Maximizing Your Subscription Benefits

When aiming to maximize your subscription benefits at a lending institution, recognizing the variety of resources and services available can significantly improve your economic health. Federal credit report unions offer a variety of advantages to their participants, including affordable rate of interest on cost savings accounts and fundings, reduced charges compared to conventional banks, and individualized check out this site customer care. By maximizing these advantages, members can boost their economic stability and achieve their objectives more properly.

Additionally, taking part in economic education programs and workshops provided by the credit history union can aid you boost your money administration skills and make more informed choices about your economic future. By actively involving with the sources offered to you as a participant, you can unlock the full potential of your relationship with the credit history union.

Verdict

Finally, the benefits of signing up with a federal credit history union consist of reduced costs, affordable prices, customized client service, and community-focused efforts. By optimizing your subscription advantages, you can access price savings, tailored solutions, and a feeling of belonging. Take into consideration opening the benefits of a government from this source cooperative credit union today to experience a banks that focuses on member satisfaction and uses a variety of resources for economic education.

Furthermore, Federal Credit history Unions are not-for-profit companies, permitting them to supply affordable interest prices on financial savings accounts, lendings, and credit cards.

Federal Credit Unions often give financial education and learning and sources to aid members boost their financial literacy and make educated decisions regarding their cash.

Report this page